Download Vinum Market Report March 2025

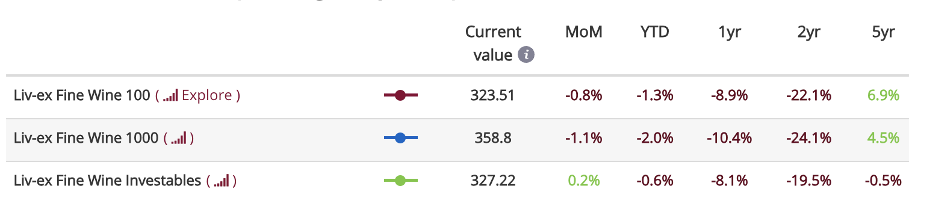

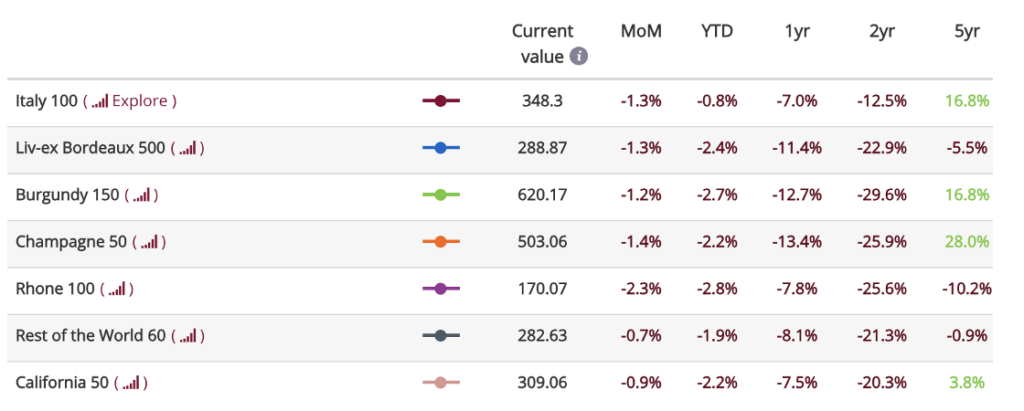

Another month has passed, and the leading wine indices have retreated a little further. I imagine it pains the reader as much as the author to read these words again. The only index to post any gains was the ‘Investables’, hauled up by some mature vintages of Bordeaux.

Happily, there are some areas of positivity! One sector that has seen a rise in prices recently has been the auction markets, reported on separately here.

There has again been a rise in monthly traded volumes also. At Vinum, we have traded good quantities of DRC and Rousseau in Burgundy and plenty of mature, high-end Bordeaux but perhaps the biggest takeaway of the month has been the firm demand for large format items of big-ticket wines – there are clearly some big celebrations being planned! Monfortino ’10, La Mission ’89 and Masseto in various vintages all selling well in double magnum formats.

Looking at what we’ve sold, and the wines that have contributed to the Liv-ex Fine Wine Investables index’s positive February performance, the obvious conclusion is the wealthy drinker is alive and well and enjoying these lower prices. Lucky them!

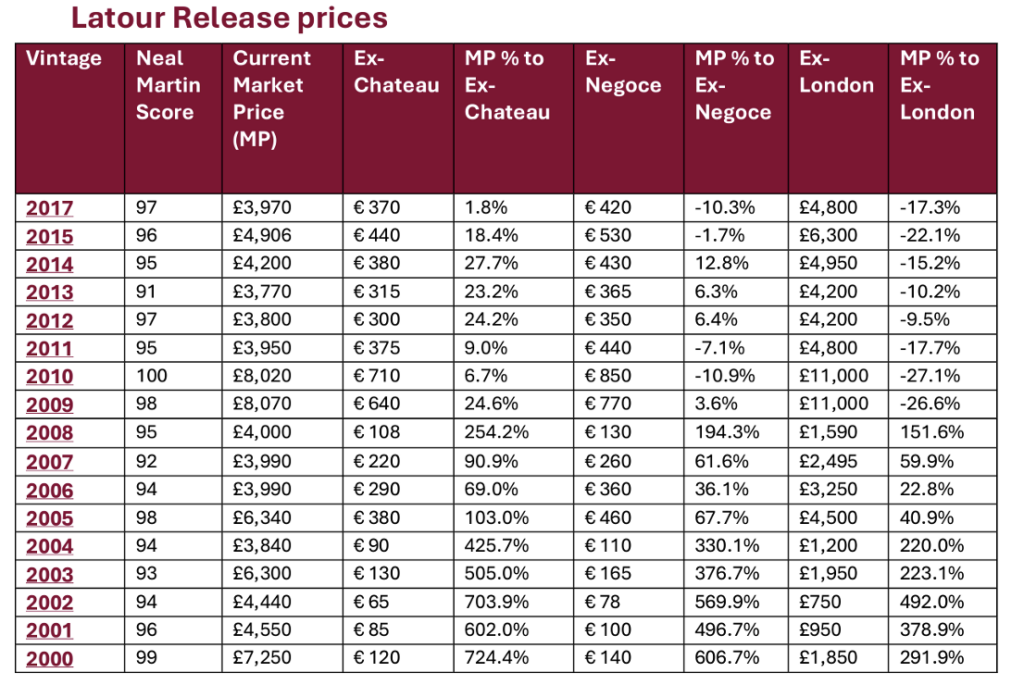

We have recently reported on the upcoming release of wines from Chateau Latour on March 17th, please see here for details and tasting notes. Included will be the titanic 2016 Grand Vin, a multiple 100 pointer and up there with the legendary ’61, ’82 and 2010. All ‘wine eyes’ will be watching; this is the most significant release from the Chateau since Latour withdrew from the en primeur system over a decade ago. Given the indications of interest we have received, the release will be a success.

Ex-Chateau pricing is expected to be €530-550. At this level the 2016 will look favourable compared to the 2009/10 and will work for a wine of this stature and with perfect provenance. Anything more and there’s a risk the Titanic may sink. The timing of Latour’s release is important to the market, it is craving some excitement, at all levels.

During the current malaise, release prices from producers have been causing a lot of concern/despair amongst wine market participants. Producers have cited shortages of wine from follow on vintages (Burgundy ’24 for example), which has merit as an argument, but devaluing the brand and upsetting customers who have bought at higher prices are risible excuses. Brands are more likely to devalue themselves with this sort of attitude.

Obviously, the international news flow couldn’t be heavier. Just when we thought the geopolitical situation couldn’t be any more volatile, President Z met President T in the Oval Office, and we all know what happened next. That and tariff talk means volatility everywhere is high and unlike during Trump’s previous term the markets are not enjoying it. Also, tariffs are likely to lead to inflation and hamper any further interest rate cuts – a fine tightrope is being walked. Impact was obviously high on the President’s agenda on his return, and he has certainly achieved that! Let’s hope there are calmer times ahead.

The wine market normally does best when the ‘feel good factor’ abounds, although the Covid-19 period was an (extraordinary) exception to that. Obviously, a lack of stability geopolitically and economically does not normally encourage growth in wine prices. We do, however, find ourselves in a brave, new world where the norm is being challenged, and we are all becoming more accustomed to volatility. The fear of negative real interest rates bolsters the argument for Gold, and even Bitcoin, as safe havens, so with some wine prices down 30%+ already…. Just stick to the really, really good stuff like the wealthy folk!

Miles Davis, 12th March 2025

All charts and tables courtesy of www.Liv-ex.com