Download Vinum Market Report January 2025

2024 proved to be a second consecutive year of falling prices for fine wine assets. Whilst some commentators have been calling it the worst market in a generation, and whilst there is no argument prices have been on the slide, trading turnover at Vinum Fine Wines in ’24 was slightly higher than in ’23. We are still behind the heady levels of ’22 however. December ’24 was our best December in recent memory and the new year has started brightly. As such, we go into 2025 with a little more optimism, with sales of rare Burgundy and mature Bordeaux leading the way.

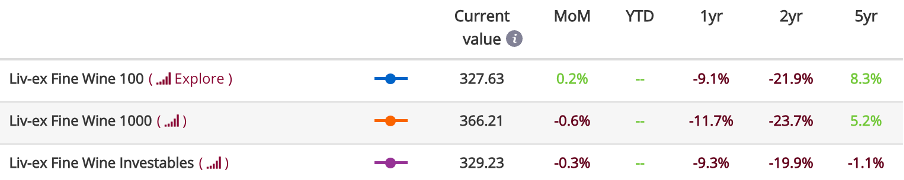

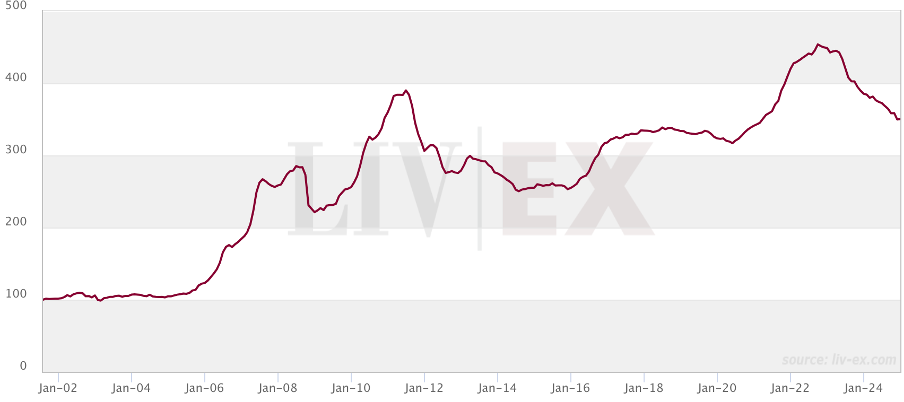

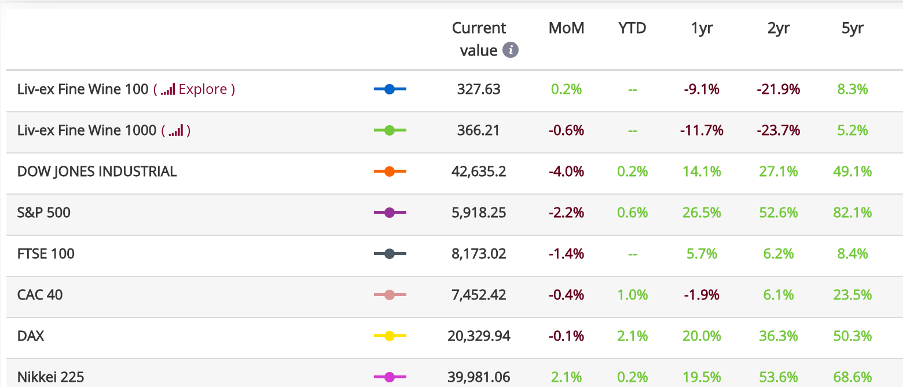

Declines for these leading indices, representing various collective markets were all in the region of -10% for the year. Regional indices were not far away from this number, the only substantial outlier on the downside was Burgundy which retreated15%, whilst Italy outperformed its peers with a drop of 6.8%. Champagne was a little weaker than the mean with a fall of 11.7% but all three of these markets are still substantially in the black over a five-year period. The same cannot be said about Bordeaux and its various sub-component indices, all of which have declined other than the Left Bank 200, which has managed to rise by one percentage point over the same period. Holders of Bordeaux may find these five-year numbers more sobering than they would like.

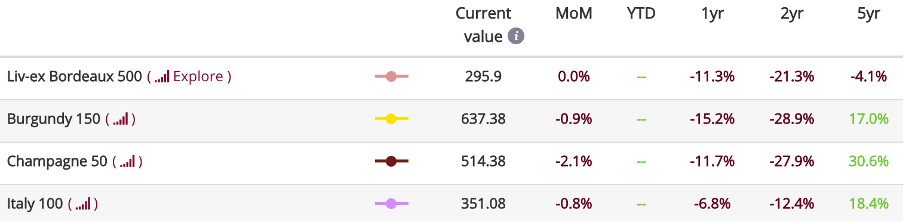

It is probably wise to add some context at this point. Taking a five-year view, it looks like nothing much has changed; the indices levels are within a 10 per cent range of what they were then, but the charts (see below) tell another story; the interim period has seen a significant, and unusual, rise and fall.

The outbreak of Covid-19 had market participants fearing the worst initially but the ensuing lockdowns bore unusual and unexpected reasons to inflate the wine market, namely increased disposable income and extreme boredom. Investing in and buying wine from the bedroom was fun.

Bordeaux’s reaction to the pandemic was to release the well regarded 2019 vintage en primeur at a level interesting enough to generate some genuine demand – a rare thing in the modern era! Rising prices followed, fuelling demand (somewhat paradoxically), particularly from a new wave of investors. Unprecedented levels of fresh cash flooded into the market and fine wine prices were off to the races. Producers jumped aboard the band wagon, particularly the Burgundians given their measly ’21 vintage, and release prices soared too.

These were the times before the global geopolitical landscape started shifting significantly, before Russia invaded Ukraine, before inflation took a hold and interest rates began to climb. It was also the time before Trussonomics*, a particularly painful blow to the middle ground of UK wine buyers. All in all, the last five years have been the most turbulent times most of us have ever experienced.

* Trussonomic policies were unveiled by the short-lived British PM Liz Truss, and her Chancellor, in the mini-budget of September 2022. It triggered a dramatic sell-off in the UK bond and currency markets.

Having come this far, it now makes sense to look at the last five years in the context of the last fifty years, or so. Liv-ex’s oldest index, the Liv-ex 100, originates in 2002 but if it had originated any earlier the trend line would have been much the same as the one demonstrated in the chart below. The age-old premise that prices of the finest wines will rise over the long term, due to the almost unique fundamentals of finite supply being met with sustained demand (again, over the long term), is a correct one. Following the market conditions of the last two years perhaps we, and the wider market, need to remind ourselves of this?

Obviously, there’s no such thing as a straight line in asset prices (unless your name is Madoff), so downturns along the way are to be expected. Historically we have typically seen one (two in the noughties) seismic global event each decade that has caused the wine market to retreat:

70s: Oil crisis (’73)

80s: Stock market crash (’87)

90s: Asian currency crisis (’97)

00s: Dotcom bubble (‘01) and Global financial crisis (’08) although neither had lasting effects

10s: China’s anti-corruption campaign (’11). An aside: it has been reported that, as of 2023, 2.3 million government officials have been prosecuted!

20s: Covid-19 recession, geopolitical tensions and slowdown in China

The reasons for these corrections are always different, and there are always new factors to consider each time, as there is this time around, but the outcome has traditionally been the same.

According to Google, the Year of the Snake in 2025 represents transformation, wisdom, and intuition. The author, himself born a snake, will go with this, particularly the transformation element!

There are still headwinds in the fine wine market and the mood is sombre, although there are reasons for optimism, even if they are currently hiding in the shadows. It takes courage to be contrarian in this kind of environment, but those that have it often outperform. In the meantime, signs of consolidation in the oil tanker-like market will be encouraging. I am not predicting the wine market indices will post any gains this year, but I am sure 2025 will throw up some highly attractive opportunities, in terms of both quality and rarity of stocks and their price levels, and that courage is to be encouraged! Burgundy ’23 will be interesting, Bordeaux ’24 could be, if mainly out of curiosity – the repricing of one lacklustre vintage will not be enough to reignite the region and there is a lot of overpriced stock already in the system.